Written by: David Omakwu

Henry Louis Le Chatelier a renowned French chemist is popular for his theory on equilibrium in a chemical system. He stated that

“For a chemical system in equilibrium once a change is introduced to the system, the equilibrium position shifts to offset the effects of the change.”

This implies that equilibrium positions are dynamic. In our daily lives we continually experience shifts in our equilibrium positions because, that’s the only way we can counteract the effects of changes in our lives. Changes are a constant variable in our existence whether it be in our relationships, career, health, social status, wealth or finances.

Here at Versal Vest, we study these changes at the micro and macro levels as it relates to the financial health of the economy. We then shape our portfolio decisions to gain the maximum opportunities presented by the ever-shifting economic landscape.

In the first half of 2023, we have seen the economies of the world slowly but steadily swagger towards some form of economic equilibrium to balance out the effects of the drastic flux experienced over the last the last three years from an investor’s view point.

These imbalances presented as;

- the deteriorating political and trade relationship between the world’s second largest economy China, and the USA, some part of Europe and the western world

- the dreadful pandemic that swept through the world (again China was a major variable here)

- the Russian war in Ukraine

- the Brexit saga, and the political instability in the British government.

- Supply constraints on different commodities globally

- The shifting political rhetoric globally

Looking through these matters we can postulate the causes of these changes and in doing so find the hidden gems they present. Globalization has faced a rude reckoning the world over in the last few years with the global political rhetoric shifting towards protectionism. The USA enjoys a global influence and this has been threatened by China’s Belt and Road experiment. These two great nations sit at the pinnacle of global trade. This experiment sees China creating links between herself and emerging market economies on any continent she can get her tentacles on through infrastructures like highways, ports and airports connecting her with the world, soft loans to African countries and a handful of politically unstable south American countries. China was carrying out this project at break neck speed. The political rhetoric in USA at this time conveniently became protectionism with the emergence of President Trump. Tariffs and embargos on trade between the two countries and trading partners of these countries became the reality of the day. This created a shift in supply chain and revealed the level of dependence each of these nations had on each other. The game of checkmating each other began in earnest. President Trump trumped China at every turn not minding the adverse effects this had on the US economy. The unintended consequence of this chess match was that it somewhat put everyone on the defensive before the unfortunate CORONAVIRUS hit the world.

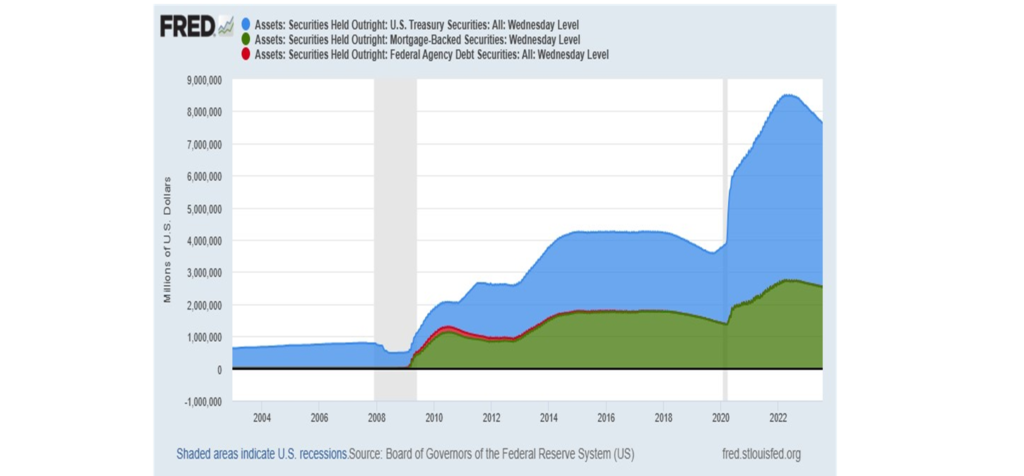

The world shut down or attempted to. Migration halted to almost zero. The air held the world hostage at death’s door. CORONAVIRUS had arrived. The virus crippled the economies of the world with a stoic efficiency. Demand and supply chains broke down somewhat globally. Central banks tried their best to keep economies on breathing. The Federal Reserve especially tried to jump start the US economy pumping so much money into its economy (that was already inflated) for households, and institutions by lowering interest rates to a near zero percent, injecting liquidity to the financial markets through her securities buying programs.

The BOE, BOJ, ECB and other major central banks engaged in so called special programs to resuscitate their economies. These programs were a series of qualitative and quantitative easing programs designed to absorb the shockwaves brought on by the dreadful virus. These programs although positive in some sense also created a negative shift in the economy in form of inflation.

Another seismic shift taking place during this period was BREXIT. This in its own way put a stain on Europe’s linen. A major party in the European alliance (England) had called it quits over economic woes in her marriage to Europe. It was somewhat a messy and long-drawn-out divorce. while Europe and England were seeking new relationships an old bully came to the playground. Russia invaded Ukraine, annexed Crimea and threatened her other bordering neighbors not to join any unholy or holy alliance called NATO. This has cascaded into a full-on war with Ukraine. The ports of Ukraine where food commodities especially grains came out from was shuttered and Russia tried to drive the oil supply to unprecedented levels to counter the effects of severe sanctions that had been placed on her and her untouchable Oligarchs. By no means is this an exhaustive list of the economic missteps taken around the world over the last three years (stretch it further, the last two decades) that has gotten us to this point where we find ourselves on the economic equilibrium position individually or institutionally.

“Courage is knowing what not to fear” – Plato

Looking at the different decisions made by each of the major financial power players the world over is not to instill doubt or fear in your mind but to help you comprehend the current asset prices or mispricing and help you position your investment portfolio positively. Let’s take a look at the FED’s quantitative easing program, for example. The program was designed especially under the administration of President Obama to curb the runaway negative effects of the economic collapse brought about by the financial crisis at that time. It seemed the sensible thing to do, and arguably it was. Nevertheless, not all the parties involved played fair, and soon enough, the FED found herself feeding an insatiable dog, Wall Street. The money the FED was pumping out into the economy through her easing programs was being pocketed largely by the middle-man (Wall Street banks). Little to nothing trickled down to the masses. This, in turn, exacerbated the excessive wealth inequality already prevalent in American society. Soon enough, the masses rose in revolution. The politicians built their manifestos around the prevalent rhetoric at the time and this led to a shift in the political power. The economy experienced this shift as the protectionist view of President Trump (the new Sheriff in town).

As investors, taking the long view on the short-term economic movements of today helps us position for the fat profits of tomorrow. Still using the case of America, one can ask: has there been a reasonable change in the well-being of the American household to necessitate a shift from the Trumpian ideologies? The current data still polls Trump as a strong candidate for the American Presidency come 2024. The possibility that Donald Trump wins the election has not been encouraged by the smell surrounding him, and it’s this foul smell and his impulsive decision-making process that played a big role in his loss the last time. But, the ideology for which he won his election is still popular among the masses. The economy under current President Biden is saddled with woes of job cuts, bank failures, and possible war with China and/or Russia. These woes are also echoed within Europe and its allies. Therefore, the foreboding answer to the question posed above to an investor will be the dilemma of positioning one’s portfolio to withstand the shocks accompanying changes in the political stand of all these countries. The seasoned investor learns to work within the limits of certainty of the data present in the economy at any given period. The opportunities that are most dominant in a politically changing State on the short term is seen in the value of its currency. The dollar has shown a 5% change in its value over the last three years. The euro has also experienced a -2% change in the same period.

These graphs show the values of the US dollar and the Euro, respectively, with emphasis on the price change in the last three years starting from June 2020 till date.

These changes in the value of the currency present a significant prospect for investors because a currency value reflects the base country’s inflation metric, gross domestic product, and generally, her economic trade aura quicker than other assets. More importantly, though, it reflects two very important components mirrored by a momentous change to an economy: Volatility and Liquidity.

The more profitable assets in any disruptive economy usually have these two metrics of volatility and liquidity present. Volatility guarantees that the constant shift in price of an asset equals a constant opportunity for gains on the asset. Liquidity guarantees that the asset is attractive enough to a larger percentage of market participants. Currencies generally wear these two banners, especially in a fluctuating economic landscape. We can hear your questions on whether cryptocurrencies are a part of this strategy. The easy answer to that is a NO. Although cryptocurrencies are volatile assets, they sit on the extreme end of the scale with little to no fundamental data driving them. This new challenger to the old ways of conducting exchange of goods and services lacks the minimum level of efficiency, traction, and liquidity to be considered a part of our portfolio. Will it ever become a widely used medium of exchange? Let’s all watch for when the world reserve currency’s debt ceiling caves in. We digress.

The other main driver of our portfolio construction in this environment is Diversification. I know you have heard this before, but there’s no better time when this is true. One of the finest investors David Swensen of the Yale endowment fund, said during one of his lectures:

“If you diversify your portfolio for a given level of return, you can generate that return at lower risk.”

We find this thinking true. Our Equity portfolio is shaped on the basis of the necessity of the given company or industry we are attracted to and then spread across different regional baskets. Necessity being Demand and Supply of the company’s or industry’s product or service. For instance, after the dreadful virus hit the world, we decided to focus on drugs and consumer retailing industry which seemed a natural fit. We then went ahead to see the regional concentrations of these industries also taking into considerations forces like available labour demand, population of consumer countries and a host of other factors like political and socio-economic climes of both the companies and the end user in its supply chain. We narrowed down our search on four companies in US, England and India. Over the three-year period we saw a positive 43.4% increase in the share price of the US company. In England over the same period, we saw a negative 8% decrease in the share price of the company. In India though, we positioned in two companies. We saw a negative 2.8% decrease in the share price of one of the companies while the second company has shown a grand 404.6% increase in its share price all over same period. Nevertheless, the main factor that helped us position for these outsized gains remains our ability to scale demand and supply down to its necessity between our portfolio companies/ industries and the end user.

In building this portfolio, we looked into the abyss of change happening around us and tied to the best of our ability the connecting dots of opportunities lying within. We followed the shifting demand and supply narrative, the inflation narrative, the political narrative, to the new frontiers where it is settling (like in the Middle East and other emerging market economies) to pitch our tents. The opportunities are as scary as the risk but courage is knowing what not to fear. In this same philosophy, we are monitoring the change of guard with new manufacturing hubs springing up, especially in the technology sector (emphasis on semi-conductor chips). Older manufacturing hubs like China are intensifying efforts to bring cheaper versions of these products to the market. The chess match continues.

As investors, sailing with the wind of change is our guaranteed road to the treasure islands, be they new or old.

Great!

Your approach to portfolio diversification is both thoughtful and dynamic, adapting to changing market conditions and identifying opportunities across different regions and industries.

Understanding the necessity of companies and industries, coupled with a thorough analysis of regional factors is definitely a tool to wield.

Your willingness to navigate the complexities of the market and embrace change underscores a proactive investment strategy. Keep up the good works.

In Depth! Great one👏